The invisible hand of capitalism is amazing. If you go into a store, the goods you want are almost always there. If you think about it, this is astonishing, considering that the goods will often be manufactured halfway around the world from raw materials sourced from a multitude of countries. One can’t design the economy to work so efficiently, bringing goods and materials to where they’re needed when they’re needed. Frankly, the beauty of how it all shakes out leaves me in awe.

So, I understand why some people view capitalism with reverence, believing that the government should keep its hands off, letting people and corporations do whatever they believe is in their own self-interest. The problem is people always seem to be willing to let it go too far, and you start to find examples where the beauty turns to ugliness.

Enron

At one time, Enron was the darling of the energy industry. It was even named American’s Most Innovative Company by Fortune for six straight years. The problem was, one of their innovations was in creative accounting, resulting in a company with $111 billion in revenues plunging into bankruptcy.

To me, however, the most interesting part of that story wasn’t the fraud, but rather the manipulation of the energy markets. During California’s energy crisis, Enron encouraged energy suppliers to shut down power plants. This led to rolling blackouts, causing the price of energy to spike exponentially, up to twenty times its normal peak values. Of course, the lack of electricity inconvenienced both businesses and consumers. I imagine it probably killed a few people who depended on air conditioning or relied on electricity to power medical equipment. But Enron made money, so they viewed such issues as irrelevant.

Bayer

In the early 1980s, Bayer was selling a hemophilia drug, Factor VIII, make from human blood plasma. When AIDS came along, they discovered some instances where Factor VIII was contaminated with the virus. The drug was made in large batches and there was no test for AIDS yet, so it wasn’t possible to determine which batches were contaminated, and which weren’t. So, the drug was banned in the USA.

That was a problem for Bayer. It had all these drugs—and was continuing to make more for months after the ban—but couldn’t sell them in its biggest market. Throwing them away would cost Bayer millions. Instead, of destroying them, they shipped them overseas, continuing to sell for another year. In Hong Kong and Taiwan alone, over 100 hemophiliacs using the medication contracted HIV.

Nestlé

Nestlé, too, had a problem. They weren’t selling enough baby formula, particularly in underdeveloped countries. For them it was a nearly insurmountable challenge: their baby formula didn’t stack up well against the primary competing food for babies—mother’s milk. Mother’s milk is free, has nutrients and antibodies not present in formula, and doesn’t rely on having a clean source of water—a rarity in some countries. How on earth could Nestlé sell its product when mother’s milk was so compelling, so clearly superior?

Nestlé proved to be up to the task, creating a brilliant marketing strategy. They supplied the infant formula to hospitals for free. New mothers would start their babies on the formula, and, as a result, would often have problems with lactation. Thus, when they left the hospital, they wouldn’t have breast milk to feed their babies, and would be forced to pay for the formula. Maybe some babies died from the lack of clean water and some were malnourished, but Nestlé finally had a market for its baby formula in poor countries.

Luckily, Nestlé also has a solution to the lack of clean water—privatization. Their Chairman has said before that access to water isn’t a public right (though he has since backtracked). Nestlé’s approach is that governments should sell the groundwater that is currently being consumed by the people to Nestlé, allowing the company to package it into bottles. They will then sell it back to the people who are currently consuming it for free. Because there will be a price on water, then there will be less wastage (and larger profits to Nestlé). And, if you’re too poor to afford Nestlé’s water, they’ll benevolently give you just enough to survive (but not bathe. That would be wasteful.)

GM & Ford

The auto manufacturers provide other good examples of tradeoffs that corporations make. Take the Ford Pinto. This car was rushed to production despite pre-production tests that showed that low-speed rear collisions could cause the fuel tank to rupture and explode. This was a big problem for the company, since the fix was estimated to cost $137 million. Luckily, Ford had some good mathematicians on staff. They figured out that settling the claims from burn victims would probably be less than $50 million. Thus, they didn’t bother fixing the car.

Decades later, GM had a similar safety issue with faulty ignition switches that could cause the engine to shut off when driving at high speeds. This could not only cause an accident, but also prevent the airbags from inflating. Luckily, GMs had learned from Ford what the right thing was to do in such a situation. They calculated the cost of a recall, decided it was quite high, so skipped it. It took a decade before they finally recalled their faulty vehicles. By that time, hundreds of people had died as a result of the issue.

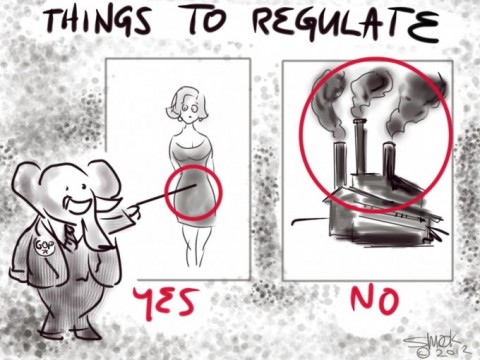

The debate

The free market proponent would argue that the invisible hand will fix these sorts of problems itself. If Pintos explode, people will eventually realize it, and stop buying Ford’s products. There are a couple of problems with this sort of argument, though.

First, it doesn’t help much if you’re one of the thousands who die. Second, as Ford, GM, and Bayer show, there are situations where the company can make more money by selling a dangerous product than fixing its problems. (Heck, why not be a snake oil salesman? You’ll only sell a million dollars worth of fraud before you’re discovered, but by then you’ll have their money and a million dollars is still a million dollars.) Third, there can be situations, like Enron or the Mafia, where you can deliberately cause misery that you can profit from. It’ll show up as positive in the GDP, but really, you’re destroying value, not creating it.

The bottom line

The way around these issues is by sensible regulation that reflects our values, such as making the cost of a human life so high that it rarely makes sense for a company to kill its customers. Or, by forbidding companies from selling unsafe products, and throwing the corporate leaders in jail when they do. In the end, it all comes down to deciding what sort of world we want to live in.

If a corporation breaks the trust, suspend it for a decade. Liquidate assets to payout non involved employees.

LikeLike